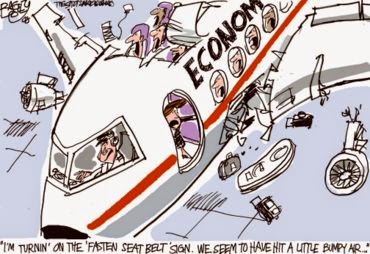

What does the beginning of an economic collapse look like?

Do you see franchises or private owned shops closing?

Do you see other retailers, like clothing stores and department stores, having more than usual clearances?

Are you making as much money annually as you did 5 maybe 10 years ago?

Do you see homes in neighborhoods becoming run down or worse? foreclosed upon? forced to sell?

Did that house down the street from you become a rental property, where new people come to live every few months?

Do you know one or two people who are looking for work? Maybe professionals, who you thought were safe in their careers?

Did your pretty well off buddy take a job minimum wage and hours because he could not find work in his field of expertise?

Don’t be fooled into thinking that the stock market is any indication of the health of an economy.

You may have witnessed many of these situations, but you tell yourself it can’t be an economic collapse because the stock market is at an all-time high.

Does that mean all is well? No, this is what a 21st century economic collapse looks like in the beginning.

These are some revised questions from Michael Gray with the New York Post. He even goes on to say,

"The divide between the haves and the have-nots is growing exponentially. If the 99 percent can’t contribute to the economy because of the dire financial situations they find themselves in, then you see gross domestic product growth reports of 1 percent, such as we have seen lately."

"Don’t be fooled into thinking that the stock market is any indication of the health of an economy.

It’s a rigged market to placate the masses — most of whom do not have much skin in the game — and convince them that all is well, when in fact the opposite is true.

We are entering the problem months for the markets. September and October are historically times of greater market volatility to the downside."

According to Michael Gray and other economists there was a time when this was very explainable.

Gray says, "In the last two centuries, huge amounts of cash would move from the Eastern money markets over the mid-to-late summer to the Midwest and Western states to buy crops, leaving the equity and bond markets in a liquidity squeeze come late summer/early fall. Now it’s down to the returning traders from the Hamptons or the Cape and realizing that their trading book looks a little sick. Their bonus will depend on them making the right moves in the next three months, and they need to sell those dog stocks soon."

So what does an economic collapse look like in the 21st century? What is listed above is just the tip of the iceberg This is based on viewing a typical middle-class suburban neighborhood.

"If you look through the prism of “Jeez, it wouldn’t take much money to fix that,” now you begin to have an answer as to why it’s not fixed." Says, Michael Gray.

Recent Comments