It is news spreading across the news blogs, and websites, under the radar while people follow the mainstream of who the next president of the united states will be. China, Russia and NATO fighting for "unclaimed" islands near the Philippines.(click here to read story)

All sides have battle ships and running "Fire Drills" and "Fly-bys" to prove military strength. Now Russia may not be directly involved with the islands, but they did send out a message by creating their own military special forces for the NATO "insurgents" invading Russian territory (read more here). This is due to a few things,. China and Russia have had a very close relationship this passed year. From trading between each other and bypassing the US Dollar for fair trade. To showing shared interest in fight against the US Dollar reign and military strong arm.

Now we know in the passed that China has been hoarding the World’s Gold Reserves, by mining A-Lot of gold and still not released any information officially as to how much they actually have.

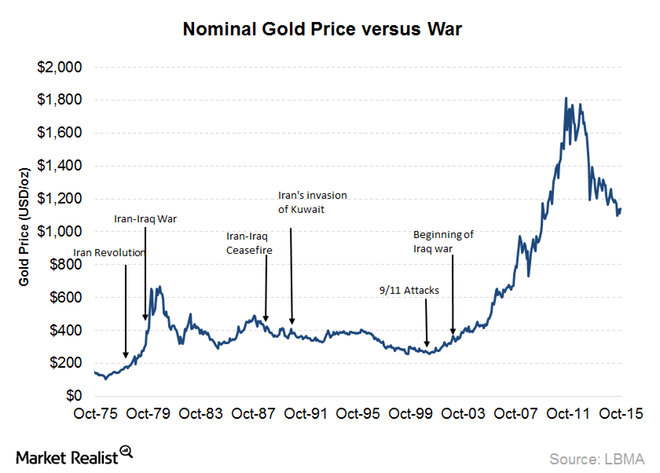

Now that leads to another question to some of us though, which could concern all of us: "What would this war mean for GOLD and other precious metals?"

Annie Gilroy from Yahoo finances said this:

"Gold’s safe haven appeal might lead investors to gold and other precious metals in terms of heightened geopolitical tensions and war. Not only are other asset prices affected immediately in the event of war or even the threat of it,

butwars also mean excessive money printing and accelerated government spending.

It’s no surprise, then, if investors turn their attention to gold and other precious metals. We’ll see how gold has reacted to the rumors of a war or to a run-up to war."

Look at the statistics below:

As you can see, every war and build up to, gold has increased more and more. Perhaps it is time we start to heed the warnings, and prepare for something greater….

-Admin

Recent Comments